Cross-Border Wire Transfer: AML Compliance under PMLA

With the world economy coming closer and increasing digitization, global trade and finance activities are also rising. This has resulted in increased use of cross-border wire transfers to move funds. With this, the risk of exploitation of this method by financial criminals to transfer illicit funds from one country to another has also heightened. To check on this threat, India’s Prevention of Money Laundering Act, 2002 (PMLA) requires financial institutions to apply specific anti-money laundering measures on such cross-border wire transfers.

This article elaborates on the AML compliance requirements under PMLA when the transaction is related to cross-border wire transfers.

Why is AML Compliance crucial in the case of Cross-Border Wire Transfers?

When cross-border wire transfers are involved, the risk of financial crime increases, not just for the regulated entity but also for the world economy as a whole. Thus, it becomes pertinent for the involved financial institutions to prioritize the necessary AML checks and measures to detect and deter potential vulnerabilities.

Any non-compliance with AML checks concerning cross-border wire transfers may result in severe consequences such as imposing heavy fines and penalties, loss of reputation and customer confidence in the business, potential operational challenges, etc.

To ensure the integrity of the global financial systems, implementing adequate AML checks becomes crucial for financial institutions when executing international wire transfer transactions.

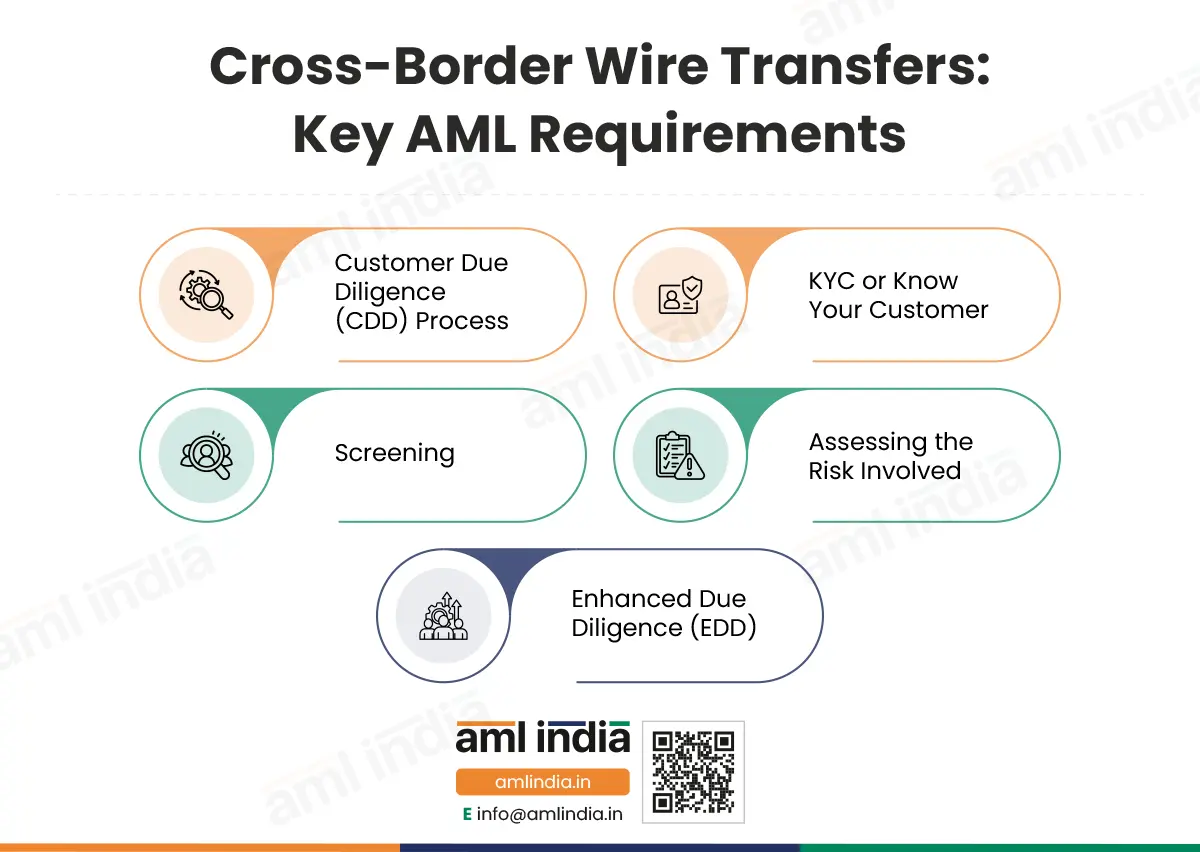

What are the essential AML Compliance Requirements under PMLA around Cross-Border Wire Transfers?

To prevent the misuse of the financial systems, in accordance with PMLA and the Prevention of Money Laundering (Maintenance of Records) Rules, 2005, the reporting entities (financial institutions) are required to adhere to the following AML compliance requirements when conducting cross-border wire transfer transactions:

Customer Due Diligence (CDD) Process

When conducting an international wire transfer, the regulated entities must identify the parties involved. Here comes the role of one of the critical components of the AML program – Customer Due Diligence.

CDD is a process involving measures aimed at identifying the customers, beneficial owners, etc. and determining the potential financial crime risk such customers can expose to the business. CDD consists of the following measures, which the regulated entities must adopt for the originator and beneficiary involved in the wire transfer:

KYC or Know Your Customer

The financial institutions must obtain information about the originator and the beneficiary (such as name, contact details, unique identification number, address, nationality, etc.), including seeking a valid Passport or any other government-issued identity document bearing a photograph. It is important to verify these details using reliable, independent sources.

The financial institutions must inquire about the purpose of the transfer and the intended use of funds to bring more transparency around the transaction.

Screening

The parties to the transaction must be screened against the sanctions lists (such as UNSC Sanctions Lists, Ministry of Home Affairs list of banned persons and organizations, and any other relevant international sanctions lists). Screening must also be conducted to check for a person’s status as a Politically Exposed Person (PEP) or association with any PEP.

Assessing the risk involved

Once the information about the concerned transaction is available, the regulated entities must perform a risk assessment to identify the possible degree of money laundering or terrorism financing risk that may arise, such as the particular cross-border wire transfer. Based on the risk categorization, the entity must determine if any additional checks or risk mitigation measures are required.

Enhanced Due Diligence (EDD)

In cases where the risk assessed is “high”, the entities must proceed with Enhanced Customer Due Diligence measures to manage the increased risk. Here, inquiries around the originator’s source of funds and wealth must be made, and senior management approval must be sought for executing such high-risk cross-border wire transfer transactions.

Ongoing Transaction Monitoring

The regulated entities executing cross-border wire transfers must establish and maintain a strong ongoing transaction monitoring system to detect suspicious transfers. The monitoring program must be designed with adequate rules and thresholds to flag potential anomalies, such as:

- Frequent transfer of funds to a party in a foreign country without any business sense

- Transferring funds to a party in a high-risk country known for aiding the terrorist organization or money laundering activities.

- Executing large-value cross-border wire transfers contrary to the financial profile of the person’s business.

- Transfer involved foreign PEP or entities associated with a sanctioned person.

The monitoring systems must be comprehensive and robust, capable of evaluating a large number of international transfers on a time basis, and trigger warning signals when anything unusual is identified.

Reporting the suspicious transactions to the Financial Intelligence Unit

When any cross-border wire transfer is suspected of involving any proceeds of criminal activities or is believed to be attempted to launder dirty money, the regulated entities must promptly report the same to the Financial Intelligence Unit of India (FIU-IND) by filing Suspicious Transaction Report (STR).

Filing Cross-Border Wire Transfer Report (CBWTR) with FIU-IND

Additionally, irrespective of the fact whether any red flags are observed or not, the regulated entities are required to file a Cross-Border Wire Transfer Report (CBWTR) when the value involved is more than five (5) lakhs – in Indian rupees or its equivalent in any foreign currency. Such international wire transfers are to be intimated when the funds are either originating from India or are destined for India. The report must capture information about the following:

- Value of transfer

- Name, other identification details and address of the sender (originator)

- Name, other identification details and address of the beneficiary

- Name and other relevant details of the sender and beneficiary financial institution

- Details of the intermediary bank or financial institution

- Purpose for reporting the transaction

Only by complying with the key AML checks of Customer Due Diligence, transaction monitoring and adequate reporting to the authorities can the regulated entities protect themselves against exploitation by financial criminals and combat money laundering and terrorist financing internationally.

Best practices for ensuring AML compliance around Cross-Border Wire Transfer Transactions

- The regulated entities must design a comprehensive AML/CFT Compliance framework in accordance with the entity’s business risk exposure and regulatory requirements.

- The compliance team and the other relevant staff must be trained on the entity’s internal AML program to create awareness around AML activities and develop compliance culture in the organization.

- The monitoring system and controls must be aligned with the entity’s business risk assessment outcome to accurately analyse the relevant details and reduce the number of false positive signals.

- The entity must explore and deploy adequate technology and tools to complement the AML compliance program. The right technology can assist the business in monitoring the customers and transactions and timely generate an alert of any irregularities in the business relationship.

- Internal mechanisms must be well documented in the AML/CFT policies and communicated with the team to ensure timely reporting of suspicious activities or other transactional information, ensuring quality and adequacy of the data furnished.

Allow AML India to assist you in managing your AML compliance around Cross-Border Wire Transfers

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.