Best Practices for Selecting a Name Screening Software

As a regulatory requirement, regulated entities in India must perform screening of their existing and potential customers. The customers are screened for sanctions, watchlists, PEP databases, and adverse media. For these needs, a standard technology solution across countries is the name screening software. It helps identify such individuals and entities matching these lists. The article outlines the best practices for selecting name screening software.

Significance of the name screening software

Generally, entities use local and international-level watchlists from relevant authorities to match their customers. By this, you can identify risky customers, employees, and transactions. These lists include PEPs (Politically Exposed Persons), Sanctions, Terrorists, Drug traffickers, Weapons proliferators, and other financial criminals.

News sources and media sites are also excellent tools for news about your customers. You can sift through this news to search for the negative connotations.

By identifying criminals, you can stop transacting with them if they are existing customers. If potential, then you can avoid forming a business relationship with them.

Thus, you can prevent money laundering and terrorism financing threats to your business. Also, you can ensure AML compliance and prevent AML penalty imposition on your business.

Besides, with a name screening tool, you can ensure result accuracy due to the absence of human errors. You also screen the names against updated lists, improving the preciseness of your results. Also, such tools can screen massive datasets, saving time and money. With the rise in your customers and transactions, the system can handle huge workloads without compromising the quality.

Having such software shows your commitment to enabling secure transactions and business. Identifying a robust and effective name screening software is a critical activity. Since it is crucial for your AML compliance, you can make mistakes in the selection process. So, we bring you a list of best practices to adopt while selecting a name screening software.

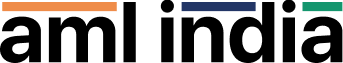

Name Screening Software Features

Ensure that the Name Screening Software supports the following features:

- Reliable, comprehensive, and up-to-date data sources

- Easy use navigation

- Due diligence workflows

- Batch screening

- Global coverage

- API integration

When you have these features, you get the guarantee of accurate and on-time results. You can identify risky customers, avoid them, and prevent financial crimes.

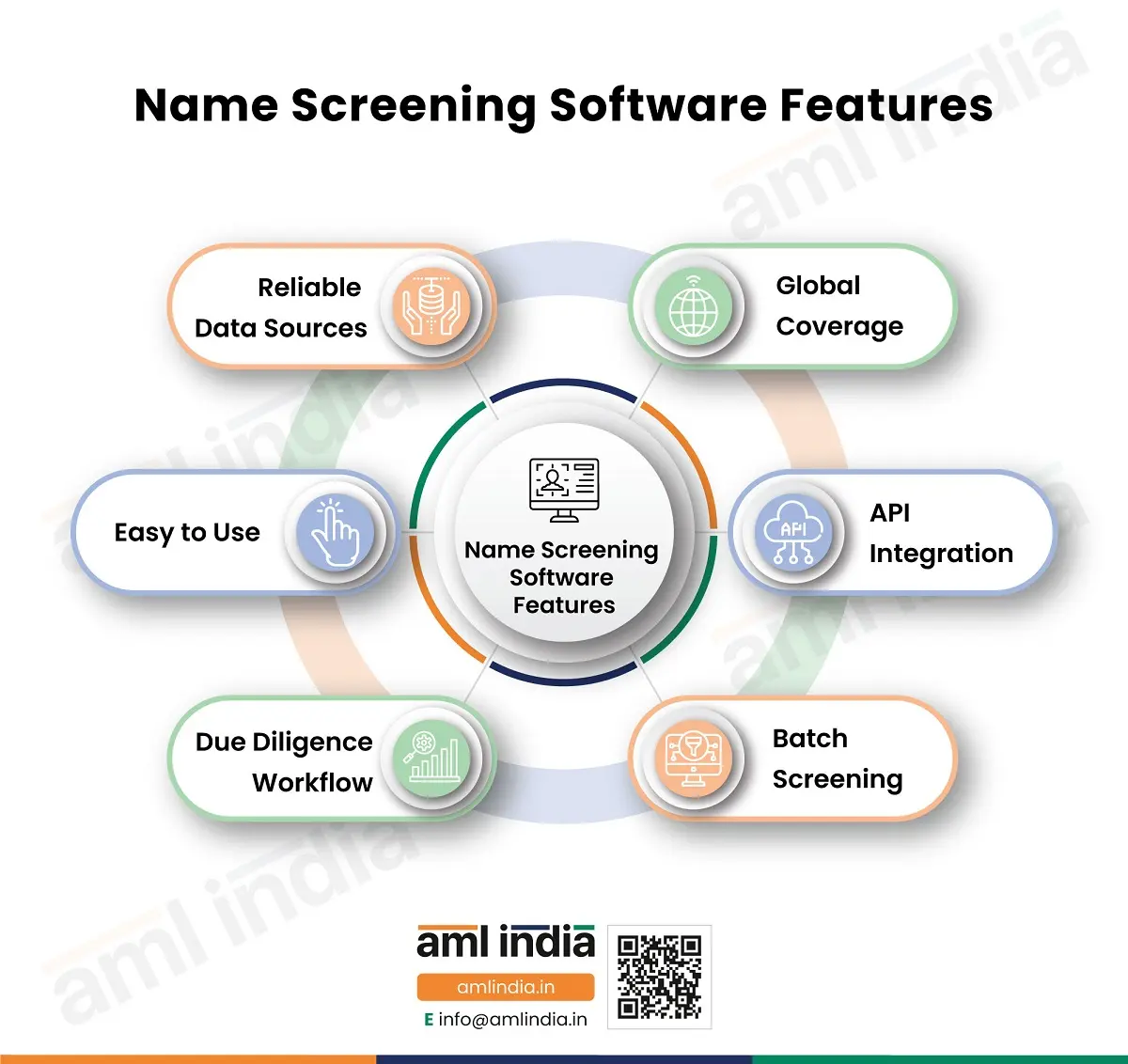

Name Screening Software Selection Best Practices

Your name screening software must be accurate and up to date. Customisation for your business needs and goals makes it more efficient and effective. Also, it must be easy to use and understand for the users. To have these features and make it useful for your business, you must follow the following best practices:

Keep in mind the evolving AML regulatory needs

The name screening solution must be able to check your customers’ names in any of the watchlists. If they appear in the list, you will not transact with them. If not, you can identify them as genuine and unrelated to financial crimes. In such cases, you can form business relations with them. Thus, it is a medium to keep you away from money laundering threats.

You can follow AML regulations with it. That is why you must consider the evolving nature of India’s AML regulations. The solution must stay updated to include all relevant AML regulations. Also, it must comply with the global sanctions, watchlists, and regulations. Complying with industry-specific requirements can be a significant value addition.

User interface and experience must be top-class

The effectiveness of a technological solution depends on its user interface and experience. A similar case is the case with a name screening solution. It must be easy to learn, understand, train, use, and navigate.

So, while selecting sanctions screening software, ensure it has these capabilities. The user interface must be intuitive to make its use smoother and understandable. This feature results in efficient performance of the solution and user satisfaction.

Ensure that the solution is scalable

In future, your business will grow. You will have more customers, employees, and transactions. This will lead to an increase in data volumes. So, it would help to have a solution that can handle large datasets.

While selecting a name screening software, ensure that the system is scalable. It must be able to adjust to the rise in data volumes. Even if your data increases, it must be able to match with the watchlists and generate results for your business. Thus, you do not need to change the software even when your company grows.

Accurate results must be the prime feature of the solution

What is the first feature you will look for in name screening software?

Accurate results. Preciseness.

So, while selecting the solution, please pay attention to its accuracy. Research on the algorithms used for building the solution. Understand the parameters based on which the solution defines rules to generate results.

Since it is a name screening system, it should eliminate false positives to reduce your time and effort. So, try to reduce the number of false positives and false negatives. This is possible only if the parameters, factors, and rules are correctly set. You can expect higher accuracy if these are defined per industry needs and local and global watchlists.

Name screening becomes challenging when the customers belong to countries that do not use the Latin alphabet. Conversion of these names has a higher chance of inaccuracies. So, ensure that the screening algorithm does not only focus on the full name. It must include the parameters of acronyms, aliases, spelling variations, nicknames, and other minor differences.

Report creation must be possible in the sanctions screening software

Choose a solution that also produces reports on the generated results. Reports are the proof of the results generated by the name screening solution.

You will need these reports to submit to your senior management and authorities. It will help you determine which customers are sanctioned individuals/entities and which are not. Your management can decide whether to start or continue the business relationship. The authorities may need these reports as proof of matches with the watchlists and as a regulatory record-keeping requirement.

Customisation is the key differentiator

If you are required to comply with AML regulations in India, you must be one of the following:

- Financial institutions

- Virtual asset service providers

- Participants of the securities market

- DNFBPs (casinos, CA, CS, legal professionals, jewellers, real estate agents, etc.)

Despite the same regulations, risks, transactions, customers, business models, and processes differ. Due to these distinctive features, the AML frameworks, policies, procedures, and controls will be unique.

Also, the unique business needs of an entity make it different from other entities in the same or different industry sectors. That is why the solution you select for name screening needs customisation per your preferences.

In the AML scenario, your risk appetite and tolerance differ from other players. This factor also impacts the customisation you need in the name screening system. You will have rules, thresholds, and criteria for matching customers with watchlists.

There is also a difference in the sensitivity of transactions for different customers. So, consider all these factors while deciding the matching thresholds of the solution. For all these reasons, it is crucial for you to look for customisation while selecting the name screening solution.

Data security and privacy of the solution is a priority

Your name screening software has loads of information on your customers. You need this information to match with the watchlists. But you cannot compromise on the confidentiality of this data.

So, you must select a solution that keeps the data secure and private. It must enable encryption of data and secured data transmission to avoid security lapses. Also, the solution must follow the data protection rules in India. Thus, you must ensure that the data remains confidential and secure.

Aligned with EWRA and AML/CFT program

The name screening software must fulfil the regulatory compliance requirements and ensure alignment with the Enterprise-Wide Risk Assessment (EWRA) and the AML/CFT program implemented by the entity. The name screening software must be configurable for fuzzy matches and approval workflows in line with the AML/CFT framework.

Integration with existing systems

Integration with the existing systems makes your work smoother. It becomes easy for you to run the name screening process in alignment with other workflows. Your processes become efficient and faster.

For example, integration with the system you are using for KYC and CDD can work out best. Since these solutions handle customers, they have a shared database of customers’ information. With one database, an integrated solution can generate results for KYC, due diligence, and name screening.

Employee training is a requisite for a successful run of the software

What will happen if you install a name screening solution and your employees do not know how to operate it? No ROI of such a solution. Therefore, you must train your employees on the new solution to generate quality results.

Besides training on using the name screening system, you must also explain the purpose of doing this process. Points like:

- Necessity of AML screening

- Process of conducting it

- Regulatory compliance requirements

Once they understand these, they can better contribute to the name screening process. Moreover, they must know the latest regulations to incorporate them into the parameters, rules, and thresholds.

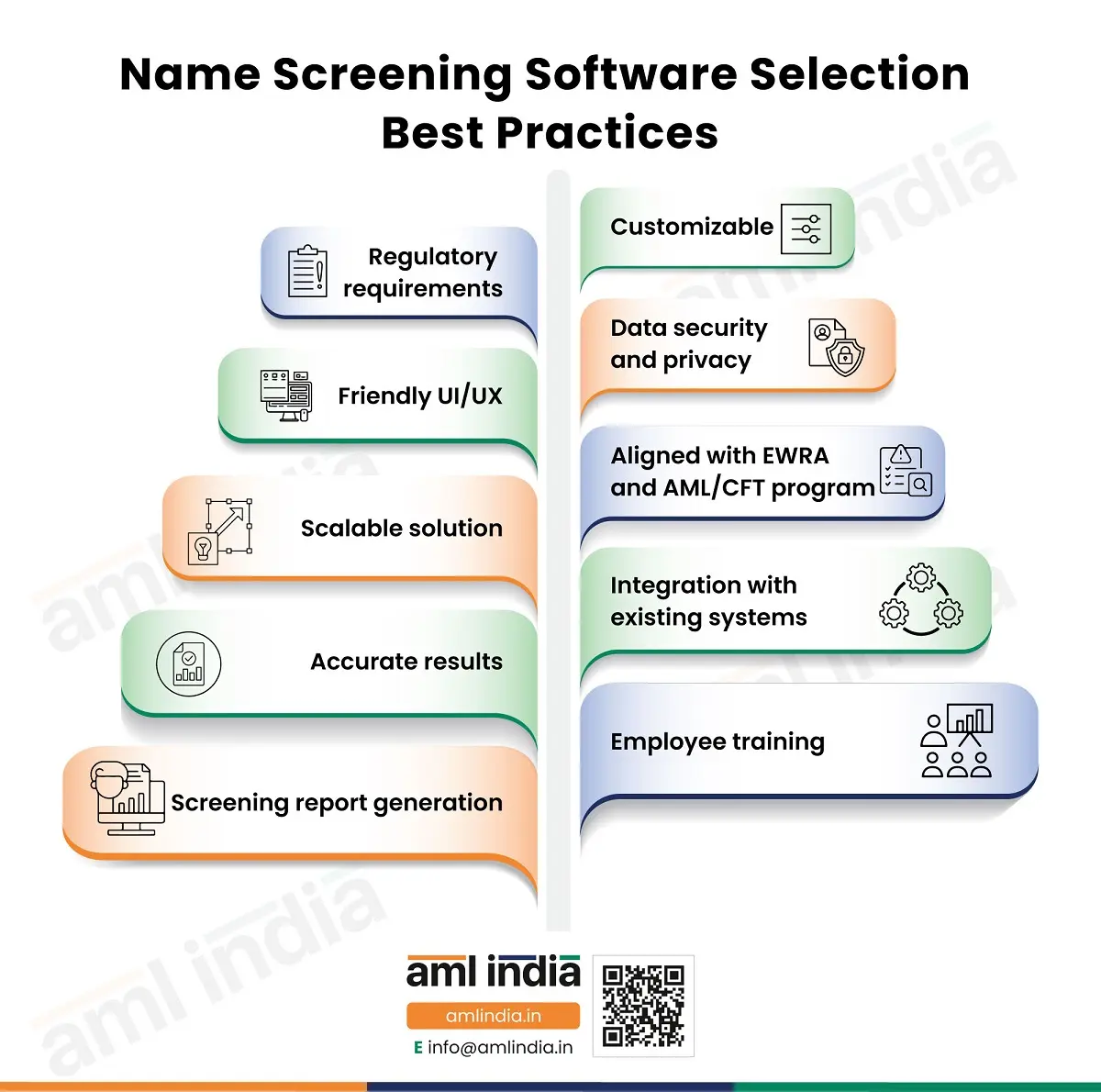

Selection of the right vendor providing the name screening software is a game changer

Above are the key features and capabilities you must have in your name screening solution. But you need to find a vendor who will provide such a solution, along with support services. So, selecting the right vendor is crucial for your AML screening process.

- Willingness to customise the solution per your needs

- Training and support services

- Customer testimonials of successful solutions and services

- Frequency and regularity of software update

- Up-to-date watchlist database

- A dedicated team to handle your project

- Integration services

Need help in selecting a name screening software?

If you need help selecting an appropriate name screening software vendor, AML India can help you. We can help you shortlist vendors and finalise one for the right sanctions screening solution for your needs. We ensure you get the name screening solution, implementation support, training, and post-installation services.

We also conduct AML screening for our customers. We ensure that we cover all the different watchlists to improve the result efficiency. We use the latest technology systems to generate accurate results, complete risk assessments, and follow AML rules.

AML India is a leading provider of AML compliance services in India. We provide our clients with end-to-end support to comply with all regulations. Not only this, you make your operations safe and secure from the threats of money laundering and terrorism financing. So, for any of your AML compliance needs, just give us a call.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.