Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

Entities and Activities Exempted from the Applicability of IFSCA Guidelines

Entities and Activities Exempted from the Applicability of IFSCA Guidelines

On November 18, 2024, the International Financial Services Centres Authority (IFSCA) issued a circular titled “Exempting certain entities/activities from the applicability of International Financial Services Centres Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022.“

This Circular was issued to exempt certain entities and activities from the purview of the International Financial Services Centres Authority (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022 (IFSCA Guidelines).

This update examines the exempted entities and activities while also addressing the impact of these exemptions on them.

Overview of the IFSCA Guidelines

The IFSCA was established to improve the ease of doing business in the IFSC and provide a world-class regulatory environment that promotes a strong business climate while actively mitigating financial crimes and protecting stakeholders’ interests.

The IFSCA issued the IFSCA Guidelines to protect the entities it regulates from being misused as conduits of financial crimes and to foster a safe and secure financial ecosystem.

The IFSCA Guidelines provide a comprehensive set of compliance obligations that Regulated Entities must adopt to identify Money Laundering (ML), Terrorism Financing (TF), and Proliferation Financing (PF) risks and combat them using appropriate risk mitigation measures.

We have published the “IFSCA (AML, CTF, & KYC) Compliance Handbook), providing a comprehensive guide to the entire Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) compliance journey for IFSCA Regulated Entities. It can be accessed here.

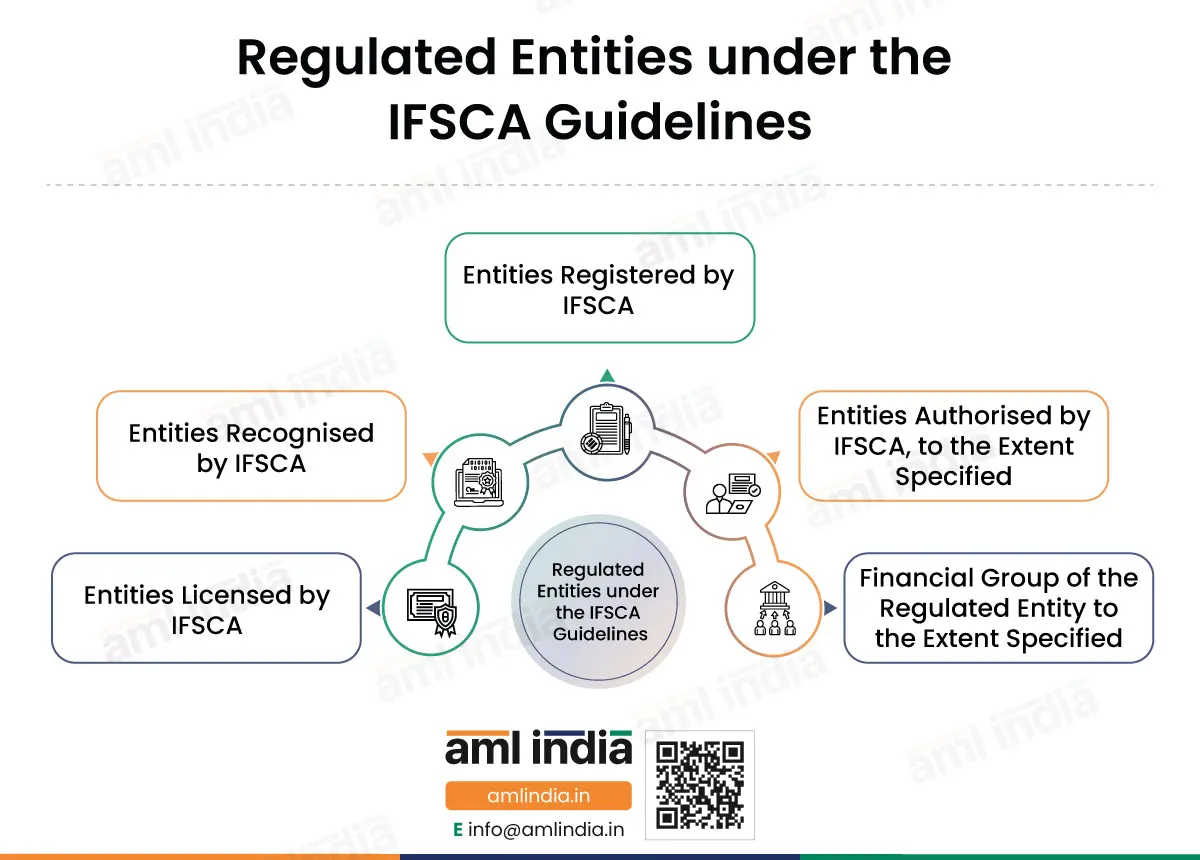

Regulated Entities under the IFSCA Guidelines

The following Entities/Units fall under the purview of and need to implement AML/CTF compliance obligations as laid down under the IFSCA Guidelines:

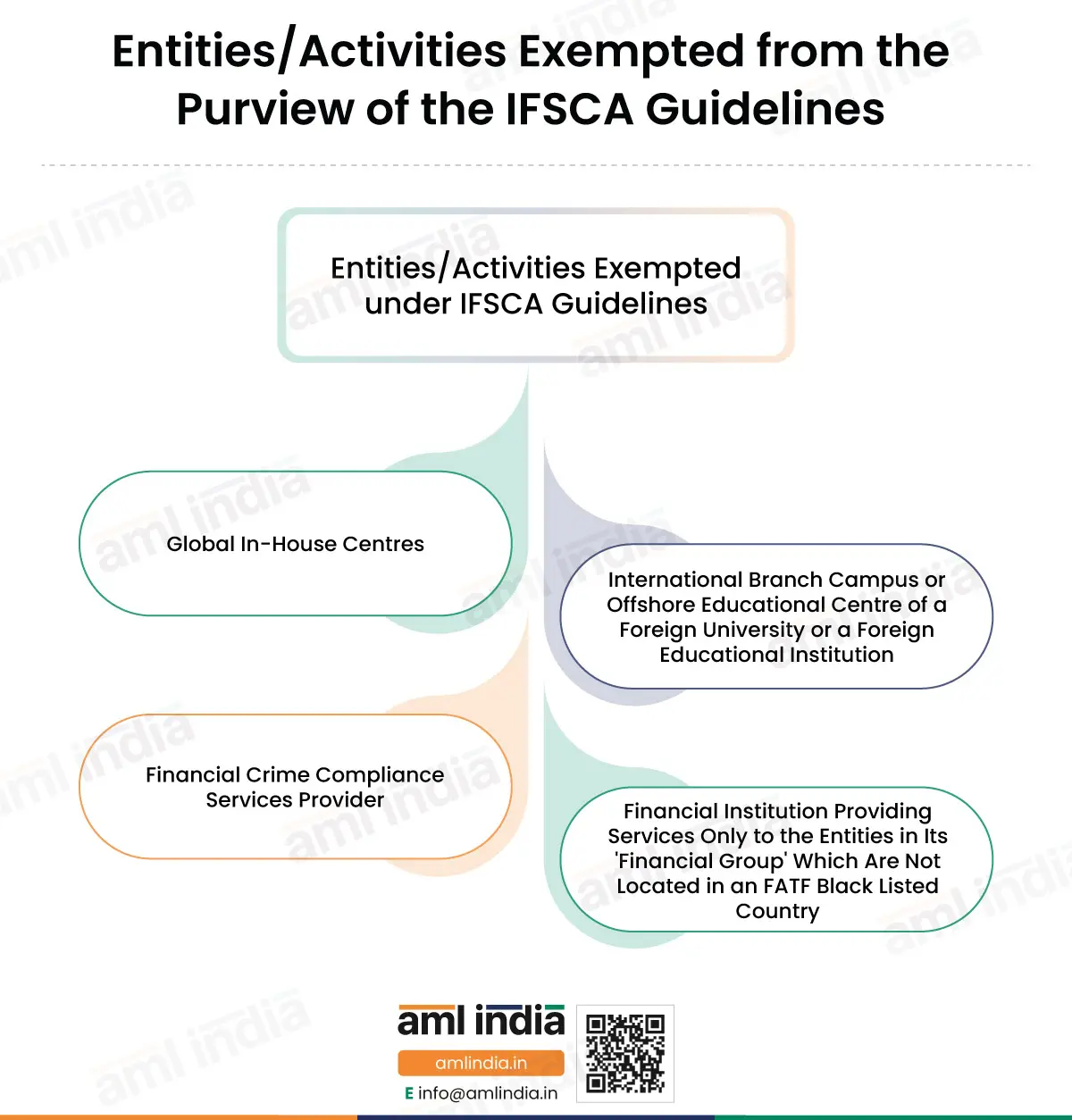

Entities/Activities Exempted from the Purview of the IFSCA Guidelines

The IFSCA issued Circular F. No. IFSCA-FCS/1/2023-Banking on November 18, 2024, exempting certain entities and activities from the compliance obligations under the IFSCA Guidelines. Here’s the list of these exempted entities and activities:

1. Global In-House Centres

Global In-House Centres are units created in the IFSC to provide support services to entities within its financial services group for carrying out a financial service in respect of a financial product. These entities are registered and regulated under the IFSCA (Global In-House Centres) Regulations, 2020.

2. International Branch Campus or Offshore Educational Centre of a Foreign University or a Foreign Educational Institution:

- International Branch Campus (IBC) is a campus established by a Foreign University in the GIFT IFSC to deliver courses, including setting up research programmes, in permissible subject areas. These Foreign Universities must be duly accredited in their home countries.

- Offshore Educational Centre (OEC) is a centre which is established as a branch by a Foreign Educational Institution (excluding Foreign Universities), in the GIFT IFSC. The purpose of these centres is to deliver courses, including research programmes, in permissible subject areas. The Foreign Educational Institution must be duly accredited in its home jurisdiction.

Both IBCs and OECs are registered under the IFSCA (Setting up and Operation of International Branch Campuses and Offshore Education Centres) Regulations, 2022.

3. Financial Crime Compliance Services Provider:

Financial Crime Compliance Service Providers are those that offer services relating to compliance with AML/CTF measures and Financial Action Task Force (FATF) recommendations and other related activities. These are registered and regulated under the IFSCA (Book-keeping, Accounting, Taxation and Financial Crime Compliance Services) Regulations, 2024.

4. Financial Institution Providing Services Only to the Entities in Its' Financial Group' Which Are Not Located in an FATF Blacklisted Country:

A Financial Institution is any entity set up within an IFSC which provides financial services in respect of any financial product. Under the present Circular, those Financial Institutions that provide services only to entities in its ‘Financial Group’ have been exempted. However, this exemption only applies when entities in the ‘Financial Group’ are not located in countries classified by the FATF as ‘High-risk jurisdictions subject to call for action’. This list of countries is also known as the FATF Black List. Currently, North Korea, Iran, and Myanmar are included in the FATF Black List.

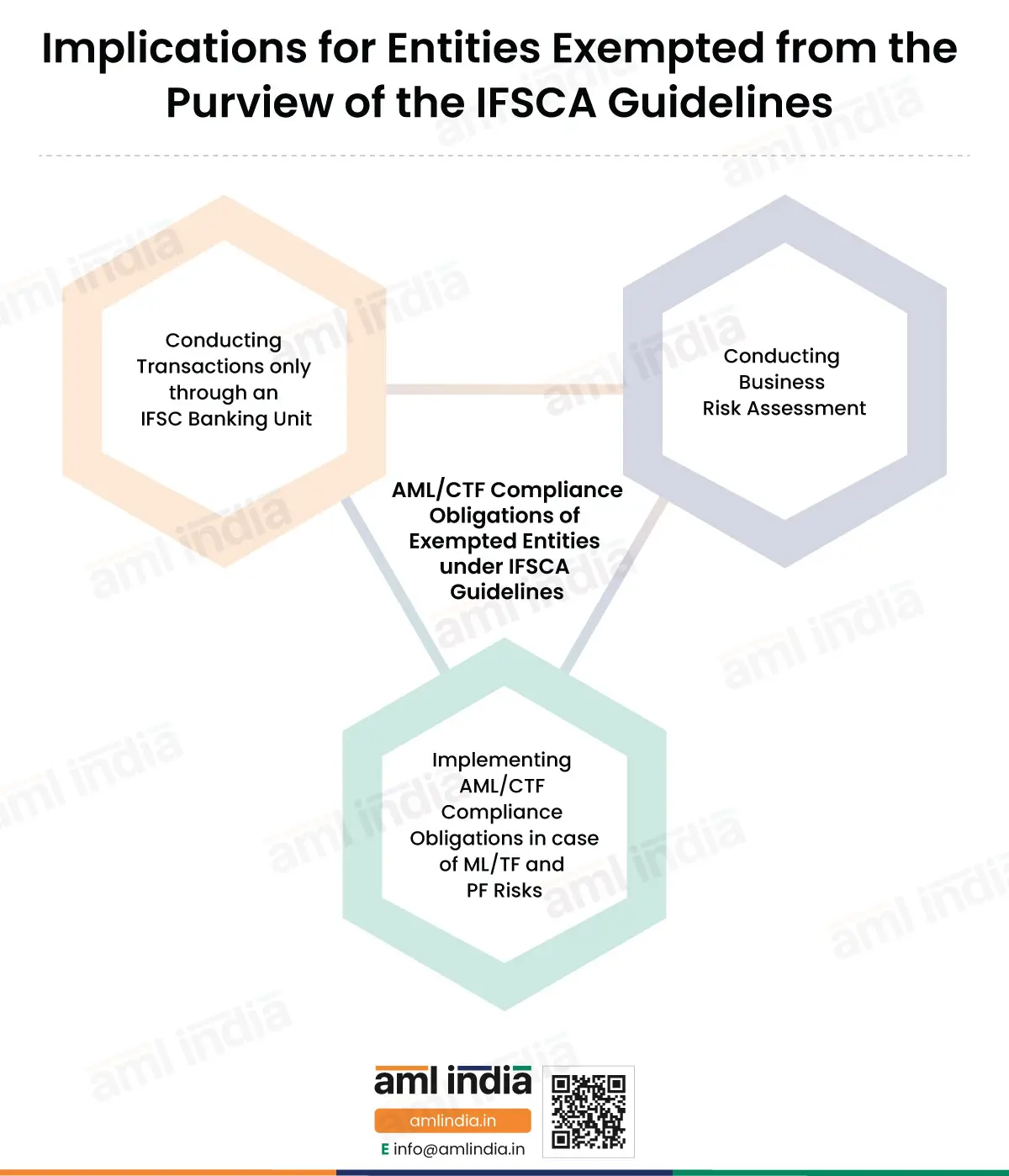

Implications for Entities Exempted from the Purview of the IFSCA Guidelines

The Exempted Entities are excluded from the applicability of the IFSCA Guidelines. However, they must still fulfil the following compliance obligations:

- Conducting Transactions only through an IFSC Banking Unit: Exempted Entities should conduct transactions or receive money consideration only through an account that is maintained with a Banking Unit operating in the IFSC.

- Conducting Business Risk Assessment: Exempted Entities should conduct a Business Risk Assessment to assess their exposure to ML/TF and PF risks. The Business Risk Assessment should be documented.

- Implementing AML/CTF Compliance Obligations in case of ML/TF and PF Risks: If the Business Risk Assessment indicates ML/TF and PF risks, the Exempted Entities must continue to adhere to the compliance obligations under the Prevention of Money Laundering Act 2002 and the Rules made under the same, as well as the IFSCA Guidelines.

Entities Exempted from the IFSCA Guidelines: Key Takeaways

- Vide Circular F. No. IFSCA-FCS/1/2023-Banking issued on November 18, 2024, the IFSCA has exempted the following from the purview of the IFSCA Guidelines:

- Global In-House Centres

- International Branch Campuses (IBC) or Offshore Educational Centres (OEC)

- Financial Crime Compliance Services Providers

- Financial Institution providing services only to the entities in its ‘Financial Group' which are located in countries not considered high-risk according to FATF.

- The Exempted Entities do not fall under the applicability of the IFSCA Guidelines.

- The Exempted Entities must still fulfil certain AML/CTF requirements such as:

- Transacting only through an IFSC Banking Unit

- Conducting ML/TF and PF Business Risk Assessment

- Implementing AML/CTF measures under the PMLA and its Rules, and the IFSCA Guidelines if ML/TF and PF risks are detected.

Important Links

subscribe to newsletter

© AML India 2023 All Rights Reserved.